vermont state tax withholding

30 of Federal. 50-State Guide to Income Tax Withholding Requirements Everything you need to know about income tax withholding in any state.

IRA distributions are subject to state withholding at 80 of the gross payment unless the IRA owner elects no state withholding.

. Calculate your state income tax step by step 6. Hawaii has twelve marginal tax brackets ranging from 14 the lowest Hawaii tax bracket to 11 the highest Hawaii tax bracket. If you want to automate payroll tax calculations you can download in-house ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically.

A state W-4 Form is a tax document that serves as a guide for employers to withhold a specific amount on each paycheck to go towards state taxes. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Depending on the state you reside in in addition to completing a W-4 Form to withhold federal taxes from your paycheck you may actually need to complete a state withholding form.

In Hawaii different tax brackets are applicable to. Legend See notes below. 43-1011Under SB 1828 and effective January 1 2022 the law createsa two-tier individual income tax rate structure of 255 and 298 depending on filing status and taxable income.

Withholding Tax Tables and Instructions for Employers and Withholding Agents p. IRA distributions are subject to state withholding at 30 of the gross payment if federal income taxes are withheld from the payment or if the IRA owner requests state withholding in writing. NON-WITHHOLDING STATE TAX WITHHOLDING There are currently ten states that do not impose a state income tax on pension and annuity income.

Chances are the answer you need is just a click away. The supplemental withholding rate is 5. If your small business has employees working youll need to understand the state law requirements for withholding.

File My Withholding Tax. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to. But if you do have a specific need that requires personal assistance weve.

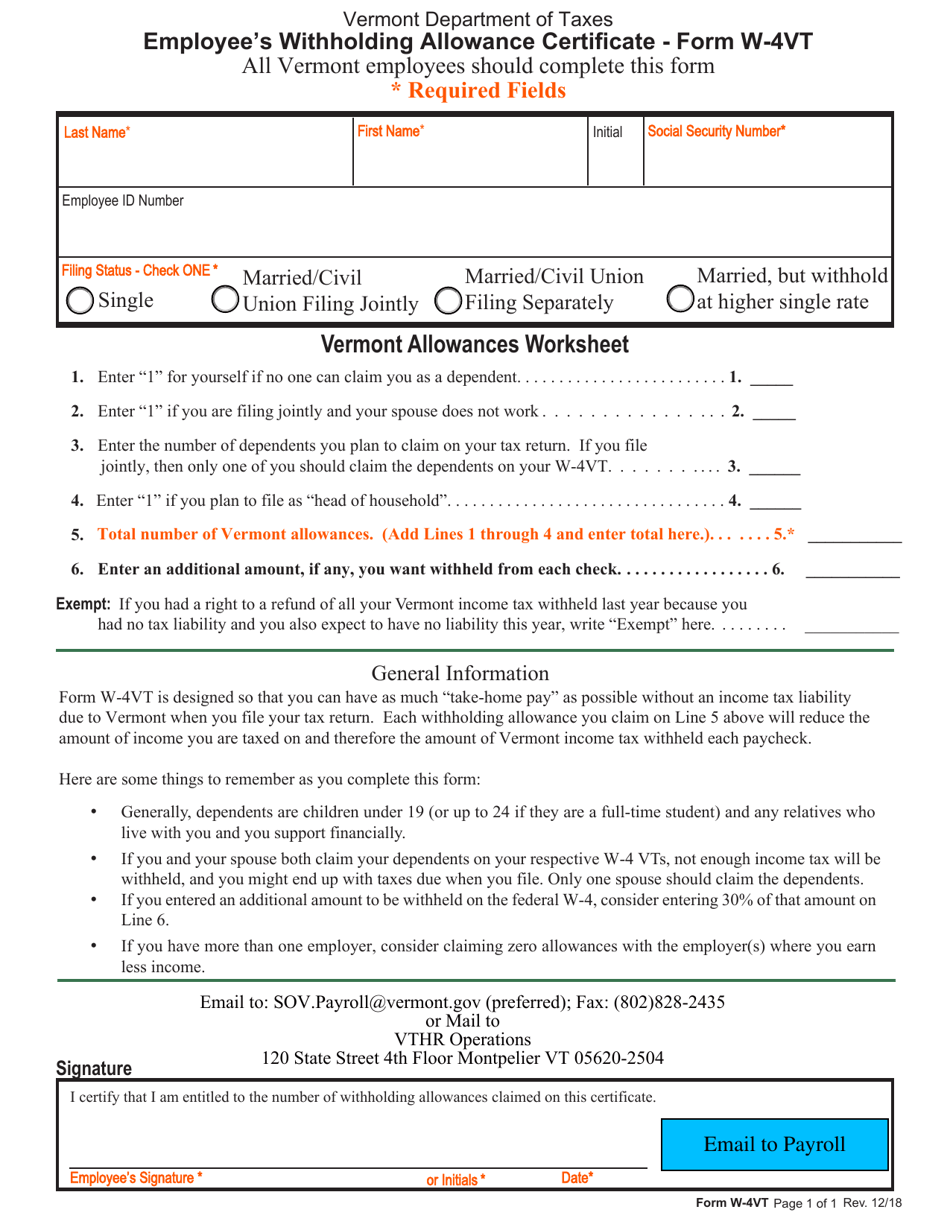

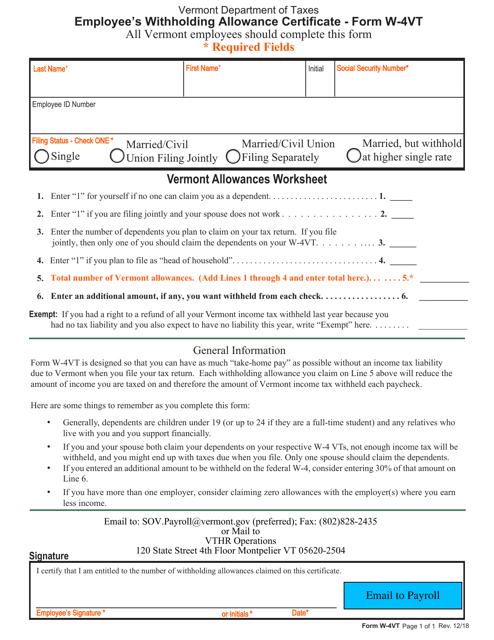

0 allowances Married with. Have Virginia state tax questions. Employees who complete a federal Form W-4 Employees Withholding Allowance Certificate are also required to complete a Vermont Form W-4VT Employees Withholding Allowance Certificate.

The Tax Withholding Estimator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck at work. Check the state tax rate and the rules to calculate state income tax 5. If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website.

What is a State W-4 Form. 30 of Federal. Both Hawaiis tax brackets and the associated tax rates were last changed four years prior to 2020 in 2016.

Vermont Department Of Taxes Facebook

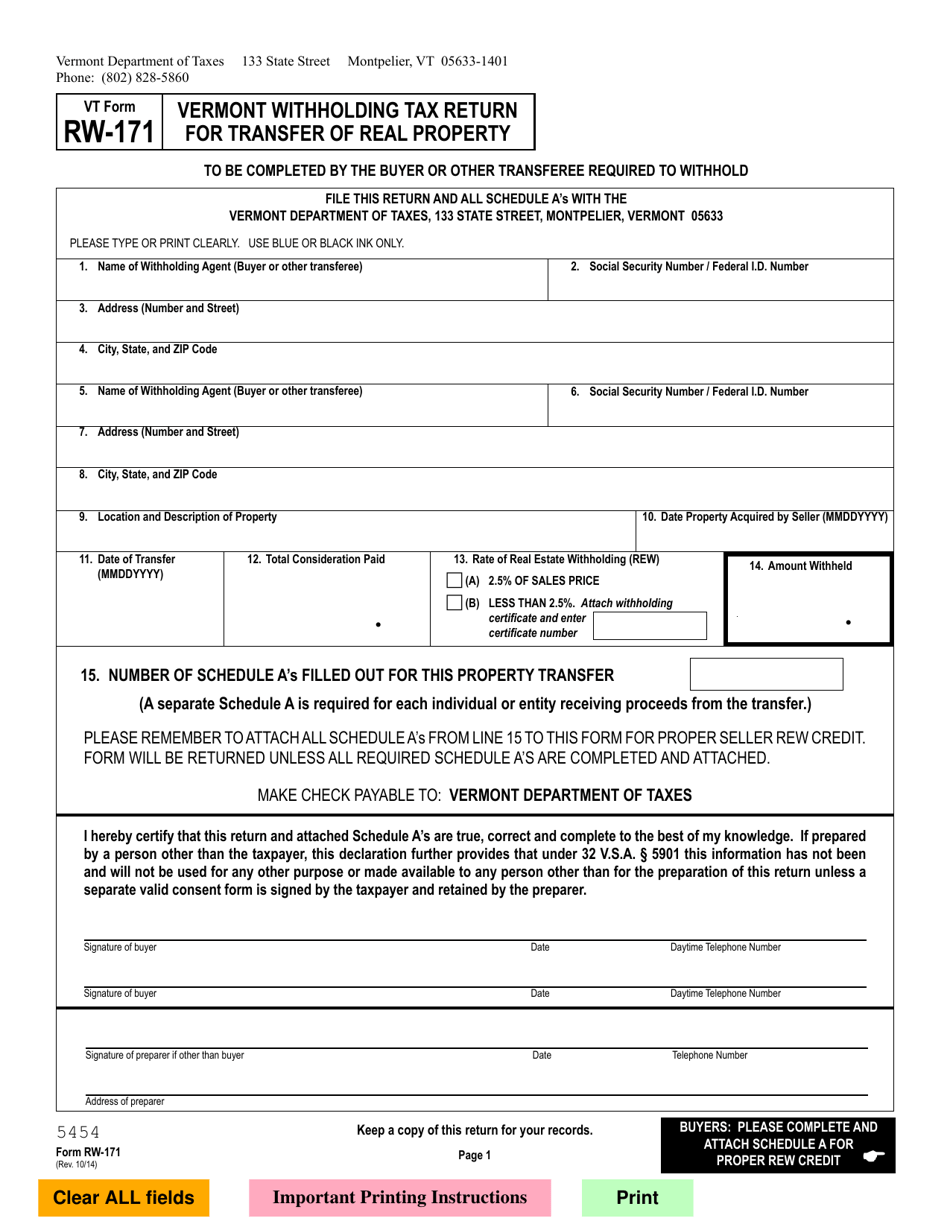

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

Free Form Rw 171 Withholding Tax Return For Transfer Of Real Property Free Legal Forms Laws Com

File Top Marginal State Income Tax Rate Svg Wikipedia

State W 4 Form Detailed Withholding Forms By State Chart

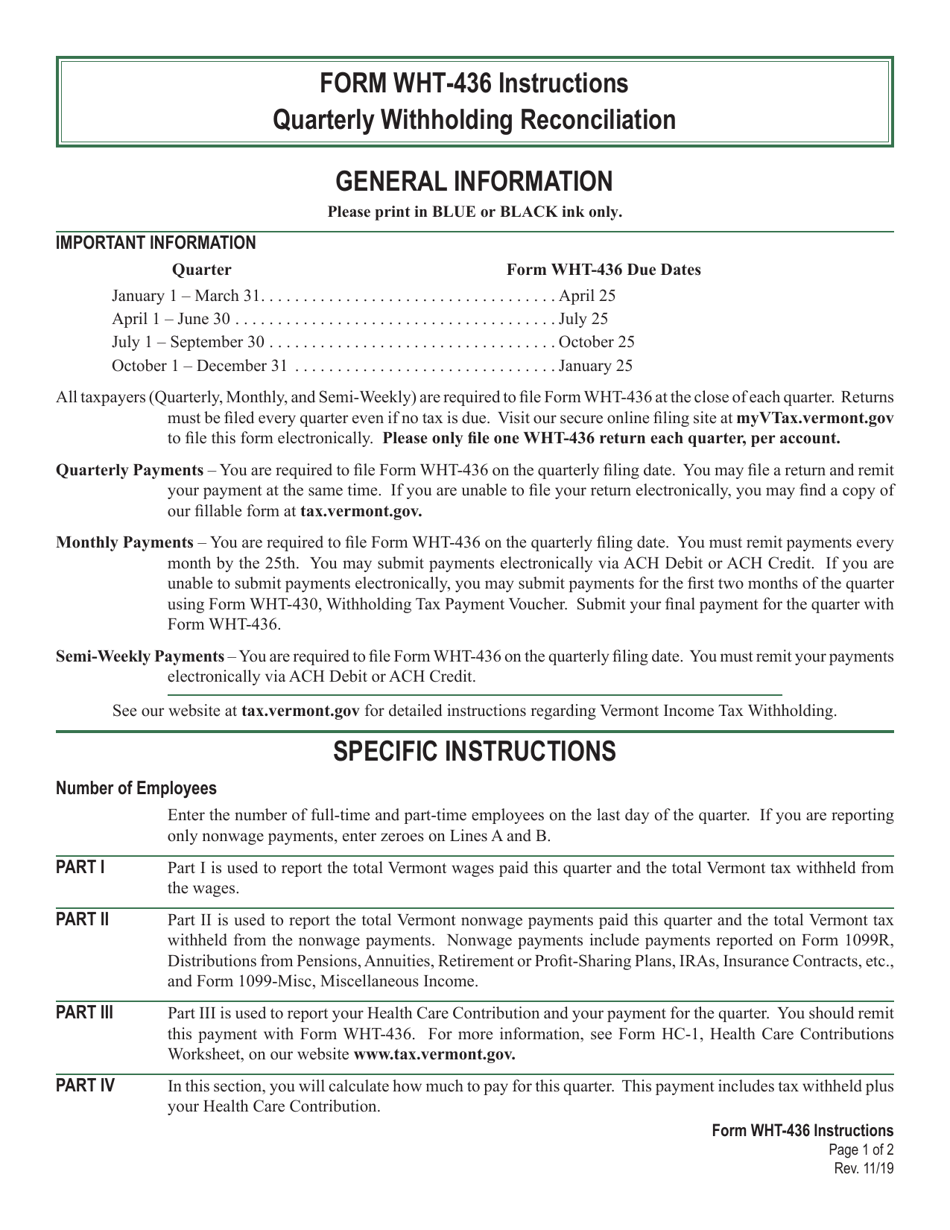

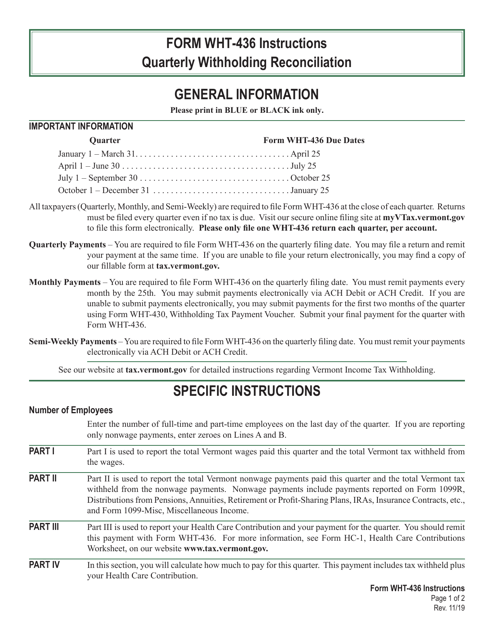

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller